權(quán)益市場(chǎng)平均收益率和股利增長(zhǎng)模型的歷史增長(zhǎng)率用幾何口徑更好?

權(quán)益市場(chǎng)平均收益率 和 股利增長(zhǎng)模型的歷史增長(zhǎng)率 都是用幾何口徑更好,?

問題來源:

![]()

![]()

![]()

![]()

張老師

2021-08-15 15:32:18 2017人瀏覽

是的。都是建議用幾何

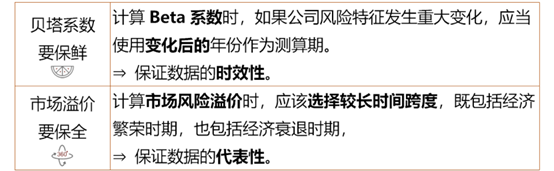

(1)權(quán)益市場(chǎng)平均收益率選擇算數(shù)平均數(shù)還是幾何平均數(shù),。主張使用幾何平均數(shù)的理由是:幾何平均數(shù)的計(jì)算考慮了復(fù)合平均,,能更好地預(yù)測(cè)長(zhǎng)期的平均風(fēng)險(xiǎn)溢價(jià)。多數(shù)人傾向于采用幾何平均法,。幾何平均法得出的預(yù)期風(fēng)險(xiǎn)溢價(jià),,一般情況下比算術(shù)平均法要低一些。

(2)幾何增長(zhǎng)率適合投資者在整個(gè)期間長(zhǎng)期持有股票的情況,,而算術(shù)平均數(shù)適合在某一段時(shí)間持有股票的情況,。由于股利折現(xiàn)模型的增長(zhǎng)率,需要長(zhǎng)期的平均增長(zhǎng)率,,幾何增長(zhǎng)率更符合邏輯,。

希望可以幫助到您O(∩_∩)O~若您還有疑問,歡迎您提問,,咱們?cè)贉贤ń涣鳌?相關(guān)答疑

-

2025-05-01

-

2025-04-30

-

2025-04-29

-

2025-04-29

津公網(wǎng)安備12010202000755號(hào)

津公網(wǎng)安備12010202000755號(hào)