母子公司之間的share-based payment

老師您好,

如果是母公司給子公司的員工做share-based payment

各自自己的賬怎么做,,不是站在合并報表角度

問題來源:

1. Introduction

It has become increasingly common for entities to pay for goods or services by issuing shares or share options. Share schemes are a common feature of director and executive remuneration. Companies whose shares or share options are regarded as a valuable currency commonly use share-based payments to obtain employee and professional services.

Improvements in accounting treatment were called for. In particular, the omission of expenses arising from share-based payment transactions with employees was believed to cause economic distortions and corporate governance concerns.

IFRS 2 applies to all share-based payment transactions. There are three types:

(a) Equity-settled share-based payment transactions (權(quán)益結(jié)算股份支付), in which the entity receives goods or services in exchange for equity instruments of the entity (including shares or share options).

(b) Cash-settled share-based payment transactions (現(xiàn)金結(jié)算股份支付), in which the entity receives goods or services in exchange for amounts of cash that are based on the price (or value) of the entity's shares or other equity instruments of the entity.

(c) Transactions in which the entity receives or acquires goods or services and either the entity or the supplier has a choice as to whether the entity settles the transaction in cash (or other assets) or by issuing equity instruments.

2. Recognition

An entity should recognise goods or services received or acquired in a share-based payment transaction when it obtains the goods or as the services are received. Goods or services received or acquired in a share-based payment transaction should be recognised as expenses unless they qualify for recognition as assets. For example, services are normally recognised as expenses (because they are normally rendered immediately), while goods are recognised as assets.

The entity shall recognise a corresponding increase in equity if the goods or services were received in an equity-settled share-based payment transaction, or a liability if the goods orservices were acquired in a cash-settled share-based payment transaction

|

Dr. Expenses Cr. Equity (equity-settled) Cr. Liability (cash-settled) |

If the equity instruments granted vest immediately, the entity shall presume that services rendered by the counterparty have been received. In this case, on grant date the entity shall recognise the services received in full, with a corresponding increase in equity.

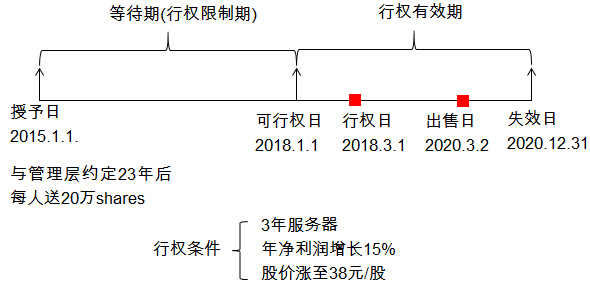

If the equity instruments granted do not vest until the counterparty completes a specified period of service, the entity shall account for those services as they are rendered by the counterparty during the vesting period (等待期/行權(quán)限制期).

王老師

2021-09-02 13:56:58 1830人瀏覽

授權(quán)日后

母公司

DR 長期股權(quán)投資

CR OCE/Equity

子公司

DR Expense/P&L

CR OCE/Equity

行權(quán)日

母公司

借:share premium

貸:長期股權(quán)投資 (行權(quán)價差)

子公司

借:OCE/Equity (行權(quán)價差)

貸:bank (行權(quán)價差)

備考時間緊迫,,著重掌握老師課上所講知識點,,應(yīng)對考試。

每個努力學(xué)習(xí)的小天使都會有收獲的,,加油,!相關(guān)答疑

-

2025-06-26

-

2025-06-14

-

2022-08-30

-

2022-07-10

-

2022-07-05

您可能感興趣的ACCA試題

- 單選題 某投資者一年前以每股40美元的價格購得股票,每年的股息為1.50美元,。目前該股的價格為45美元,,持有該股票一年的收益率是多少( )。

- 單選題 投資者已經(jīng)收集了以下四種股票的信息: 股票 β 平均收益(%) 回報的標準差(%) W 1.0 9.5 13.2 X 1.2 14.0 20.0 Y 0.9 8.4 14.5 Z 0.8 6.0 12.0 風險最低的股票是( ),。

- 單選題 公司賣出了一個看跌期權(quán),,行權(quán)價格為$56,,同時購買了一個行權(quán)價格為$44的看漲期權(quán);購買期權(quán)時股票的價格為$44,;看漲期權(quán)費為$5,看跌期權(quán)費為$4,,目前的價格上漲了$7,那么ABC公司因為看漲期權(quán)取得或是損失的金額為多少( ),。

津公網(wǎng)安備12010202000755號

津公網(wǎng)安備12010202000755號