Floating rate具體指什么,?

老師請(qǐng)問當(dāng)不用original rate而改用revisited rate的幾種特例情況下中的floating interest rate具體指什么?

問題來源:

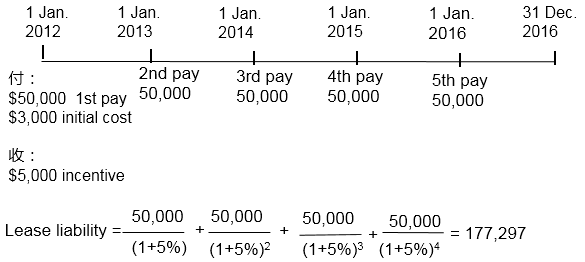

4. Lessee accounting

A lessee enters into a five-year lease of a building which has a remaining useful life of ten years. Lease payments are $50,000 per annum, payable at the beginning of each year. The lessee incurs initial direct costs of $3,000 and receives lease incentives of $5,000. There is no transfer of the asset at the end of the lease and no purchase option. The interest rate implicit in the lease is not immediately determinable but the lessee’s incremental borrowing rate is 5%.At the commencement date the lessee pays the initial $50,000, incurs the direct costs and receives the lease incentives.

Initial measurement of ROU Asset :

|

Dr. ROU Asset |

225,97 |

|

Dr. Cash |

5,000 |

|

Cr L.L |

177,297 |

|

Cr Cash |

3,000 |

|

Cr Cash |

50,000 |

Annual depreciation for ROU asset = 225,297 / 5 = 45,059.4

|

Lease liability: Bal. @1 Jan. 2012 |

177,297 |

|

Finance cost(177,297×5%) |

8,865 |

|

Bal. @31 Dec. 2012 |

186,162 |

|

2nd pay |

(50,000 ) |

|

Bal. @1 Jan. 2013 |

136,162 |

|

Finance cost (136,162×5%) |

6,808 |

|

Bal. @31 Dec. 2013 |

142,970 |

|

3rd pay |

(50,000 ) |

|

Bal. @1 Jan. 2014 |

92,970 |

|

Finance cost (92,970×5% ) |

4,649 |

|

Bal. @31 Dec. 2014 |

97,619 |

|

4th pay |

(50,000 ) |

|

Bal. @1 Jan. 2015 |

47,619 |

|

Finance cost (47,619×5%) |

2,381 |

|

Bal. @31 Dec. 2015 |

50,000 |

|

5th pay @ 1 Jan 2016 |

(50,000) |

|

I/S |

year 1 |

year 2 |

year 3 |

year 4 |

year 5 |

|

Depn expense |

45,059.4 |

45,059.4 |

45,059.4 |

45,059.4 |

45,059.4 |

|

Finance cost |

8,865 |

6,808 |

4,649 |

2,381 |

- |

|

B/S |

end of yr1 |

end of yr2 |

end of yr3 |

end of yr4 |

end of yr5 |

|

N.C.A |

|

|

|

|

|

|

ROU Asset |

180237.6 |

135178.2 |

90118.8 |

45059.4 |

0 |

|

N.C.L. |

|

|

|

|

|

|

L.L |

136,162 |

92,970 |

47,619 |

- |

- |

|

C.L. |

|

|

|

|

|

|

L.L. |

50,000 |

50,000 |

50,000 |

50,000 |

- |

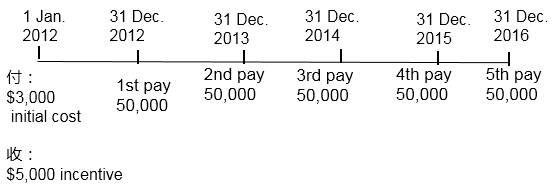

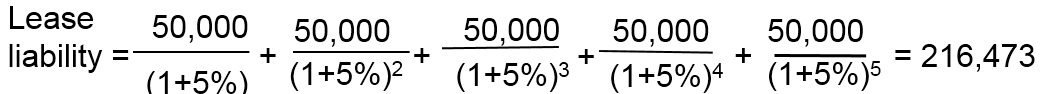

The above case can be revised: lease payment of $50,000 per annum is payable at the end of each year.

Initial measurement of ROU Asset :

|

Dr ROU Asset |

214,473 |

|

Dr Cash |

5,000 |

|

Cr L.L |

216,000 |

|

Cr Cash |

3,000 |

Annual depreciation for RoU asset = 214,473 / 5 = 42,894.6

|

Lease liability: Bal. @1 Jan. 2012 |

216,473 |

|

Finance cost (216473×5%) |

10,824 |

|

1st payment |

(50,000) |

|

Bal. @31 Dec. 2012 |

177,297 |

|

Finance cost(177297×5%) |

8,865 |

|

2nd pay |

(50,000 ) |

|

Bal. @31 Dec. 2013 |

136,162 |

|

Finance cost (136,162×5%) |

6,808 |

|

3rd pay |

(50,000) |

|

Bal. @31 Dec. 2014 |

92,970 |

|

Finance cost (92,970×5%) |

4,649 |

|

4th pay |

(50,000) |

|

Bal. @31 Dec. 2015 |

47,619 |

|

Finance cost (47,619×5%) |

2,381 |

|

5th pay |

(50,000 ) |

|

Bal. @31 Dec. 2016 |

0 |

|

I/S |

year 1 |

year 2 |

year 3 |

year 4 |

year 5 |

|

Depn expense |

42,894.6 |

42,894.6 |

42,894.6 |

42,894.6 |

42,894.6 |

|

Finance cost |

10,824 |

8,865 |

6,808 |

4,649 |

2,381 |

|

B/S |

end of yr1 |

end of yr2 |

end of yr3 |

end of yr4 |

end of yr5 |

|

N.C.A |

|

|

|

|

|

|

ROU Asset |

171578.4 |

128683.8 |

85789.2 |

42894.6 |

0 |

|

N.C.L. |

|

|

|

|

|

|

L.L |

136,162 |

92,970 |

47,619 |

- |

- |

|

C.L. |

|

|

|

|

|

|

L.L. |

41,135 |

43,192 |

45,351 |

47,619 |

- |

4.5 Remeasurement

The lease liability is remeasured (if necessary) for any reassessment of amounts payable.

The revised lease payments are discounted using the original discount interest rate where the change relates to an expected payment on a residual value guarantee or payments linked to an index or rate (and a revised discount rate where there is a change in lease term, purchase option or payments linked to a floating interest rate)

Lassie leased an item of equipment on the following terms:

|

Commencement date: |

1 January 20X1 |

|

Lease term: |

5 |

|

Annual lease payments : (commencing 1 Jan. 20X1) |

$200,000 (rising annually by CPI as at 31 Dec.) |

|

Interest rate implicit in the lease: |

6.2% |

The present value of lease payments not paid at 1 January 20X1 was $690,000. The price to purchase the asset outright would have been $1,200,000. Inflation measured by the Consumer Price Index (CPI) for the year ending 31 December 20X1 was 2%. As a result the lease payments commencing 1 January 20X2 rose to $204,000. The present value of lease payments for the remaining 4 years of the lease becomes approximately $747,300 using the original discount rate of 6.2%.

Required: Discuss how Lassie pic should account for the lease and remeasurement in the year ended 31 December 20X1.

Answer: On the commencement date, Lassie recognises a lease liability of $690,000 for the present value of lease payments not paid at the 1 January 20X1. A right-of-use asset of $890,000 is recognised comprising the amount initially recognised as the lease liability $690,000 plus $200,000 payment made on the commencement date.

The right-of-use asset is depreciated over 5 years. Its carrying amount at 31 December 20X1 (before adjustment for reassessment of the lease liability is $712,000 ($890,000 - ($890,000 / 5)).

The carrying amount of the lease liability at the end of the first year (before reassessment of the lease liability) is $732,780 (working). On that date, the future lease payments are revised by 2%. The lease liability is therefore revised to $747,300.

The difference of $14,520 adjusts the carrying amount of the right-of-use asset, increasing it to $726,520. This will be depreciated over the remaining useful life of the asset of 4 years from 20X2.

Working: Lease liability

|

b/d at 1 January 20X1 |

690,000 |

|

Interest (690,000 × 6.2%) |

42,780 |

|

c/d at 31 Dec. 20X1 (before remeasurement) |

732,780 |

|

Remeasurement |

14, 520 |

|

c/d at 31 December 20x1 |

747,300 |

關(guān)于“低值”租賃,關(guān)注以下幾點(diǎn):

(1) A lessee shall assess the value of an underlying asset based on the value of the asset when it is new, regardless of the age of the asset being leased. (評(píng)估時(shí)應(yīng)基于該資產(chǎn)全新時(shí)的價(jià)值,,且不考慮已使用年限)

(2)The assessment of whether an underlying asset is of low value is performed on an absolute basis. It is not a question of materiality. The assessment is not affected by the size, nature or circumstances of the lessee (只考慮“絕對(duì)值”,,不考慮重要性,即,,標(biāo)的資產(chǎn)是否為低值,不同承租人應(yīng)得出相同結(jié)論)

(3)If a lessee sublease an asset, or expects to sublease an asset, the head lease does not qualify as a lease of a low-value asset.

4.7 Influence on financial ratio

While IFRS 16 has benefits for the users of financial statements in terms of transparency and comparability, it has had a significant impact on the most commonly used financial ratios, such as:

? Gearing, because debt has increased

? Asset turnover decrease

? Profit margin ratios, because rent expenses are removed and replaced with depreciation and finance costs.

王老師

2021-03-30 09:20:11 1075人瀏覽

floating interest rate指的是浮動(dòng)利率,,浮動(dòng)利率是指在借貸期限內(nèi)利率隨物價(jià)或其他因素變化相應(yīng)調(diào)整的利率。

每個(gè)努力學(xué)習(xí)的小天使都會(huì)有收獲的,,加油,!相關(guān)答疑

-

2025-06-26

-

2022-08-30

-

2022-07-10

-

2022-07-05

-

2021-09-08

您可能感興趣的ACCA試題

- 單選題 某投資者一年前以每股40美元的價(jià)格購得股票,,每年的股息為1.50美元,。目前該股的價(jià)格為45美元,持有該股票一年的收益率是多少( ),。

- 單選題 投資者已經(jīng)收集了以下四種股票的信息: 股票 β 平均收益(%) 回報(bào)的標(biāo)準(zhǔn)差(%) W 1.0 9.5 13.2 X 1.2 14.0 20.0 Y 0.9 8.4 14.5 Z 0.8 6.0 12.0 風(fēng)險(xiǎn)最低的股票是( )。

- 單選題 公司賣出了一個(gè)看跌期權(quán),,行權(quán)價(jià)格為$56,同時(shí)購買了一個(gè)行權(quán)價(jià)格為$44的看漲期權(quán),;購買期權(quán)時(shí)股票的價(jià)格為$44;看漲期權(quán)費(fèi)為$5,看跌期權(quán)費(fèi)為$4,,目前的價(jià)格上漲了$7,,那么ABC公司因?yàn)榭礉q期權(quán)取得或是損失的金額為多少( )。

津公網(wǎng)安備12010202000755號(hào)

津公網(wǎng)安備12010202000755號(hào)