問題來源:

5. Contract modification

A contract modification is a change in the scope or price (or both) of a contract.

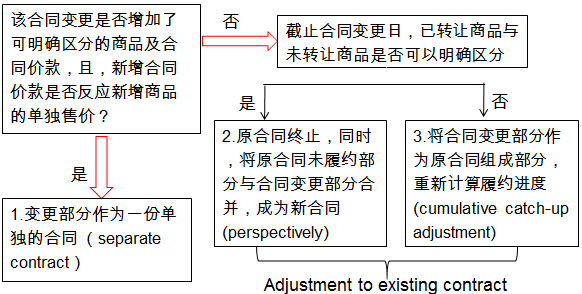

5.1 Modification is accounted for as a separate contract

5.2 Modification is accounted for prospectively合同變更作為原合同終止及新合同訂立

5.3 Modification is accounted for through a cumulative catch-up adjustment 合同變更作為原合同的組成部分

Case 1: An entity promises to sell 120 products to a customer for $100 each. Products are transferred to the customer over a six-month period. After the entity has transferred control of 60 products to the customer, the contract is modified to require the dilivery of an additional 30 products to the customer. The additional 30 products were not included in the initial contract.

1. The additional 30 products are priced at $95 per unit. It reflects the stand-alone selling price of the products at the time of the contract modification and the additional products are distinct from original products.

In accordance with IFRS15, the contract modification for the additional 30 products is , in effect, a new and separate contract for future products that does not affect the accounting for the existing contract. The entity recognises revenue of $95 per unit for the 30 products in the new contract

2. During the process of negotiating the purchase of an additional 30 products, the parties initially agreed price is $80 per unit. The entity determines that the negotiated price of $80 does not reflect the stand alone selling price of the additional products.

The new contract cannot be accounted for as a separate contract. Because the remianing products to be delivered are distinct from those already transferred, the entity should accounts for the modification as a termination of the original contract and the creation of a new contract.

Case2: 2019年1月,,A建筑公司與客戶簽訂了一項總金額為1000萬元的固定造價合同,,在客戶自有土地上建造一棟辦公樓,。 2020年初,,雙方同意更改該辦公樓屋頂設(shè)計,,并因此調(diào)整了合同價格和預(yù)計成本(總造價增加200萬元),。

Answer: The remaining goods and services to be provided using the modified contract are not distinct from the goods and services transferred on or before the date of contract modification. Thus, the contract remains a single performance obligation.

The entity should account for the modification as if it were part of the original contract and update the transaction price and the progress measurement.

2. (March/June 2017 Q3 (c))Carsoon constructs retail vehicle outlets and enters into contracts with customers to construct buildings on their land. The contracts have standard terms, which include penalties payable by Carsoon if the contract is delayed, or payable by the customer, if Carsoon cannot gain access to the construction site.

Due to poor weather, one of the projects was delayed. As a result, Carsoon faced additional costs and contractual penalties. As Carsoon could not gain access to the construction site, the directors decided to make a counter-claim against the customer for the penalties and additional costs which Carsoon faced. Carsoon felt that because claims had been made against the customer, the additional costs and penalties should not be included in contract costs but shown as a contingent liability. Carsoon has assessed the legal basis of the claim and feels it has enforceable rights.

In the year ended 28 February 2017, Carsoon incurred general and administrative costs of $10 million, and costs relating to wasted materials of $5 million.

Additionally, during the year, Carsoon agreed to construct a storage facility on the same customer’s land for $7 million at a cost of $5 million. The parties agreed to modify the contract to include the construction of the storage facility, which was completed during the current financial year. All of the additional costs relating to the above were capitalised as in the financial statements.

Required: The directors of Carsoon wish to know how to account for the penalties, counter claim and additional costs in accordance with IFRS 15 Revenue from Contracts with Customers.

Keryn的思路:

1. penalty and additional cost

2. conter claim (收$)

3. admin. and wastage

4. storage facility ( 價格7,,成本5,已完工)

1.列出履約成本資本化條件(直接+提升未來資源+可回收)

penalty and additional cost

wastage

Admin.

2. conter claim 是準(zhǔn)則示例中的“unapproved change”

(i)屬于modification (ii) no distinct G/S, 因此cumulative catch-up adjust.updating price and process (iii) 由于有Dispute, 要考慮constraint on variable consideration, 綜合考慮各種facts,,如果達(dá)不到極有可能不會發(fā)生重大轉(zhuǎn)回,,則不能計入交易價格,。

3. storage facility 屬于modification, 有distinct G/S, 個人認(rèn)為可以討論一下是否$7m反映了單獨(dú)售價。 if yes,, separate contract; if no, 原合同終止&新合同開始,。 當(dāng)期已complete, $5m與已履約相關(guān),只能計入當(dāng)期損益,。

Answer: IFRS 15 Revenue from Contracts with Customers specifies how to account for costs incurred in fulfilling a contract which are not in the scope of another standard. Costs to fulfil a contract which is accounted for under IFRS 15 are divided into those which give rise to an asset and those which are expensed as incurred. Entities will recognise an asset when costs incurred to fulfil a contract meet certain criteria, one of which is that the costs are expected to be recovered.

For costs to meet the ‘expected to be recovered’ criterion, they need to be either explicitly reimbursable under the contract or reflected through the pricing of the contract and recoverable through the margin.

The penalty and additional costs attributable to the contract should be considered when they occur and Carsoon should have included them in the total costs of the contract in the period in which they had been notified.

As regards the counter claim for compensation, Carsoon accounts for the claim as a contract modification in accordance with IFRS 15. The modification does not result in any additional goods and services being provided to the customer. In addition, all of the remaining goods and services after the modification are not distinct and form part of a single performance obligation.

Consequently, Carsoon should account for the modification by updating the transaction price and the measure of progress towards complete satisfaction of the performance obligation. A contract modification may exist even though the parties to the contract have a dispute about the scope or price (or both) of the modification or the parties have approved a change in the scope of the contract but have not yet determined the corresponding change in price.

In determining whether the rights and obligations which are created or changed by a modification are enforceable, an entity should consider all relevant facts and circumstances including the terms of the contract and other evidence. On the basis of information available, it is possible to feel that the counter claim had not reached an advanced stage, so that claims submitted to the client could not be included in total revenues.

When the contract is modified for the construction of the storage facility, an additional $7 million is added to the consideration which Carsoon will receive. The additional $7 million reflects the stand-alone selling price of the contract modification. The construction of the separate storage facility is a distinct performance obligation; the contract modification for the additional storage facility would be, in effect, a new contract which does not affect the accounting for the existing contract. Therefore the contract is a performance obligation which has been satisfied as assets are only recognised in relation to satisfying future performance obligations.

General and administrative costs cannot be capitalised unless these costs are specifically chargeable to the customer under the contract. Similarly, wasted material costs are expensed where they are not chargeable to the customer. Therefore a total expense of $15 million will be charged to profit or loss and not shown as assets.

王老師

2021-03-23 16:39:08 2072人瀏覽

哈嘍,!努力學(xué)習(xí)的小天使:

老師在上課時有時為了方便起見會簡略寫會計科目,并非所有的縮寫都是可以在答題上使用的,,為了確保得分,,建議在答題時盡量使用在書上和真題上出現(xiàn)過的縮寫會計科目。

每個努力學(xué)習(xí)的小天使都會有收獲的,,加油,!

相關(guān)答疑

-

2025-06-26

-

2025-06-14

-

2022-08-30

-

2022-07-10

-

2022-07-05

您可能感興趣的ACCA試題

- 單選題 某投資者一年前以每股40美元的價格購得股票,,每年的股息為1.50美元。目前該股的價格為45美元,,持有該股票一年的收益率是多少( ),。

- 單選題 投資者已經(jīng)收集了以下四種股票的信息: 股票 β 平均收益(%) 回報的標(biāo)準(zhǔn)差(%) W 1.0 9.5 13.2 X 1.2 14.0 20.0 Y 0.9 8.4 14.5 Z 0.8 6.0 12.0 風(fēng)險最低的股票是( ),。

- 單選題 公司賣出了一個看跌期權(quán),行權(quán)價格為$56,,同時購買了一個行權(quán)價格為$44的看漲期權(quán),;購買期權(quán)時股票的價格為$44,;看漲期權(quán)費(fèi)為$5,看跌期權(quán)費(fèi)為$4,目前的價格上漲了$7,,那么ABC公司因為看漲期權(quán)取得或是損失的金額為多少( ),。

津公網(wǎng)安備12010202000755號

津公網(wǎng)安備12010202000755號