return計(jì)算與PPT數(shù)字錯(cuò)誤解析

請(qǐng)問(wèn)MIRR這道題中求出來(lái)的1~5期的return不是應(yīng)該=-80+987+586+3515-196=4812,為什么答案給的結(jié)果是4722???

問(wèn)題來(lái)源:

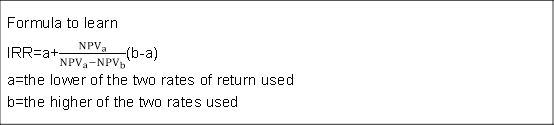

The Calculation of IRR

If calculating IRR manually, it can be estimated as follows:

Step 1 Calculate the NPV of the project at any (reasonable) rate (eg the cost of capital)

Step 2 Calculate the project NPV at any other (reasonable) rate

Step 3 Calculate the internal rate of return using the formula

Net present value working at 12%=+1,152

This analysis has been re-performed using a 20% required return as shown below:

|

Time |

0 |

1 |

2 |

3 |

4 |

5 |

|

S’000 |

(3,570) |

(90) |

1,126 |

823 |

5,527 |

(345) |

|

DF @ 20% |

1.000 |

0.833 |

0.694 |

0.579 |

0.482 |

0.402 |

|

PV |

(3,570) |

(75) |

781 |

477 |

2,664 |

(139) |

NPV at 20%=+138

Required

Using the above information, calculate the IRR Avanti’s proposed investment.

Solution

![]()

The Drawbacks of IRR

? IRR ignores the size of a project, and may result in a small project with a belter IRR being chosen over a bigger project even though the larger project is estimated to generate more wealth for shareholders.

? For projects with non-normal cash flows, Cash flows where the present value each year changes from positive to negative or negative to positive more than once, there may be more than one IRR.

? IRR assumes that the cash flows after the investment phase are reinvested at the project's IRR; this may not be realistic.

The Calculation of MIRR

IRR assumes that the cash flows after the investment phase (here time O) are reinvested at the project's IRR. A better assumption is that the funds are reinvested at the investors' minimum required return(WACC),,If we use this re-investment assumption we can calculate an alternative, modified version of IRR.

Formula provided

![]()

re=cost of capital

n=number of time periods

Net present value working at 12%=+1,152

This analysis has been re-performed using a 20% required return as shown below:

|

Time |

0 |

1 |

2 |

3 |

4 |

5 |

|

S’000 |

(3,570) |

(90) |

1,126 |

823 |

5,527 |

(345) |

|

DF @ 20% |

1.000 |

0.833 |

0.694 |

0.579 |

0.482 |

0.402 |

|

PV |

(3,570) |

(75) |

781 |

477 |

2,664 |

(139) |

NPV at 20=+138

Required

Calculate the modified IRR of Avanti's proposed investment.

|

Time |

0 |

1 |

2 |

3 |

4 |

5 |

|

Present values |

(3,570) |

(80) |

987 |

586 |

3,515 |

(196) |

The investment phase is assumed to be time 0 only.

The returns phase is therefore time 1-5 and the sum of these present values is 4,722.

![]()

The Advantages of MIRR

? MIRR is quicker to calculate than IRR

? The assumption of MIRR is better that the funds are reinvested at the investors' minimum required return(WACC)

? MIRR does not give the multiple answers that can sometimes arise with the conventional IRR.

王老師

2021-07-25 14:07:41 903人瀏覽

PPT上在第二年P(guān)V是897,,不是987,,老師PPT數(shù)字錯(cuò)了,。

每個(gè)努力學(xué)習(xí)的小天使都會(huì)有收獲的,,加油!相關(guān)答疑

-

2025-06-26

-

2025-06-14

-

2023-03-02

-

2023-02-27

-

2023-02-20

您可能感興趣的ACCA試題

- 單選題 投資者已經(jīng)收集了以下四種股票的信息: 股票 β 平均收益(%) 回報(bào)的標(biāo)準(zhǔn)差(%) W 1.0 9.5 13.2 X 1.2 14.0 20.0 Y 0.9 8.4 14.5 Z 0.8 6.0 12.0 風(fēng)險(xiǎn)最低的股票是( ),。

- 單選題 公司賣(mài)出了一個(gè)看跌期權(quán),行權(quán)價(jià)格為$56,,同時(shí)購(gòu)買(mǎi)了一個(gè)行權(quán)價(jià)格為$44的看漲期權(quán),;購(gòu)買(mǎi)期權(quán)時(shí)股票的價(jià)格為$44;看漲期權(quán)費(fèi)為$5,看跌期權(quán)費(fèi)為$4,,目前的價(jià)格上漲了$7,,那么ABC公司因?yàn)榭礉q期權(quán)取得或是損失的金額為多少( )。

- 單選題 在理性的市場(chǎng)情況下,下列哪個(gè)投資有可能獲得最低的回報(bào)率( ),。

津公網(wǎng)安備12010202000755號(hào)

津公網(wǎng)安備12010202000755號(hào)