APV中base NPV的折現(xiàn)計算

老師您好,

(1)請問截圖左下角的AF與DF縮寫是什么意思

(2)右邊的第1,2,,3,4,,5年的PV是怎么算出來的呢

謝謝老師

問題來源:

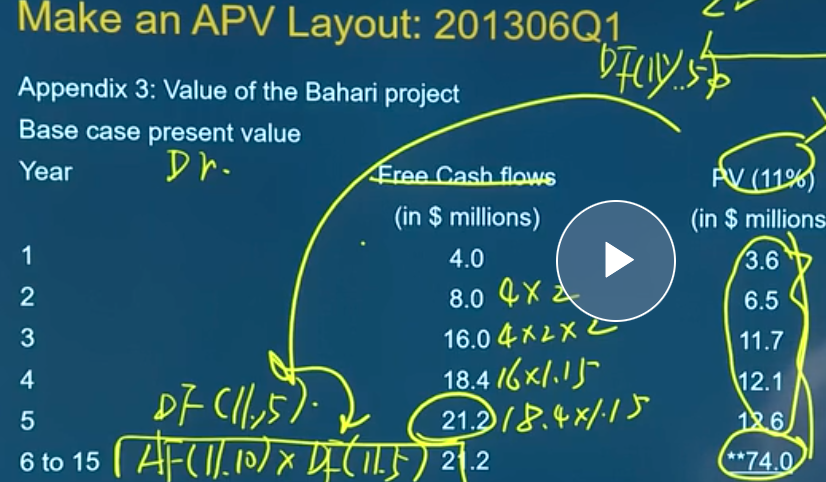

Make an APV Layout: 201306Q1

Bahari Project

Bahari is a small country with agriculture as its main economic activity. A recent geological survey concluded that there may be a rich deposit of copper available to be mined in the north-east of the country. This area is currently occupied by subsistence farmers, who would have to be relocated to other parts of the country. When the results of the survey were announced, some farmers protested that the proposed new farmland where they would be moved to was less fertile and that their communities were being broken up. However, the protesters were intimidated and violently put down by the government, and the state-controlled media stopped reporting about them. Soon afterwards, their protests were ignored and forgotten.

In a meeting between the Bahari government and Mlima Co’s BoD, the Bahari government offered Mlima Co exclusiverights to mine the copper. It is expected that there are enough deposits to last at least 15 years. Initial estimates suggest that the project will generate free cash flows of $4 million in the first year, rising by 100% per year in each of the next two years, and then by 15% in each of the two years after that. The free cash flows are then expected to stabilise at the year-five level for the remaining 10 years.

The cost of the project, payable at the start, is expected to be $150 million, comprising machinery, working capital and the mining rights fee payable to the Bahari government. None of these costs is expected to be recoverable at the end of the project’s 15-year life.

The Bahari government has offered Mlima Co a subsidised loan over 15 years for the full $150 million at an interest rate of 3% instead of Mlima Co’s normal borrowing rate of 7%. The interest payable is allowable for taxation purposes.

It can be assumed that Mlima Co’s business risk is not expected to change as a result of undertaking the Bahari project.

Make an APV Layout: 201306Q1(a2)

Required:

(a) Prepare a report for the Board of Directors (BoD) of Mlima Co that:

(i) Explains why Mlima Co’s directors are of the opinion that Mlima Co’s cost of capital should be based on Ziwa Co’s ungeared cost of equity and, showing relevant calculations, estimate an appropriate cost of capital for Mlima Co; (7 marks)

(ii) Estimates Mlima Co’s value without undertaking the Bahari project and then with the Bahari project. The valuations should use the free cash flow methodology and the cost of capital calculated in part (i). Include relevant calculations; (14 marks)

|

Appendix 3: Value of the Bahari project |

||

|

Base case present value |

||

|

Year |

Free Cash flows |

PV (11%) |

|

(in $ millions) |

(in $ millions) |

|

|

1 |

4.0 |

3.6 |

|

2 |

8.0 |

6.5 |

|

3 |

16.0 |

11.7 |

|

4 |

18.4 |

12.1 |

|

5 |

21.2 |

12.6 |

|

6 to 15 |

21.2 |

**74.0 |

|

Total |

120.5 |

|

|

**The free cash flows in years 6 to 15 are an annuity for 10 years at 11%, than discounted back for five years: 21.2×5.889×0.593=74.0 |

||

PV of the tax shield and subsidy:

Annual tax shield benefit interest paid=3%×$150m×25%=$1.1m

Subsidy benefit=4%×$150m×(1-25%)=$4.5m

Annuity factor (7%,15 years)=9.108

PV of tax shield and subsidy benefit=5.6×9.108=$51.0m

Adjusted present value=$120.5m+$51.0m-$150.0m=$21.5m

遲老師

2021-10-10 05:03:18 1415人瀏覽

1. AF代表非遞延交稅,,當年結(jié)算,當年抵稅,, DF代表遞延交稅,,是指交稅和結(jié)算不在同一年,則涉及到折算的問題 這個問題在第13講的結(jié)尾老師有重點講解與總結(jié),,如果依舊感覺不清晰可以重點復習一下這里的知識點

2.這個計算是典型的折算問題,,舉例:比如第一年 free cash flow 是 4 million,折算到起始點,,也就是0點,,4/1.11=3.6, 第2年 free cash flow 是 8 million,折算到起始點,,也就是0點,8/(1.11*1.11)=6.5,,后面以此類推

每個努力學習的小天使都會有收獲的,,加油!相關(guān)答疑

-

2023-03-02

-

2023-02-27

-

2022-10-16

-

2021-07-17

-

2021-05-30

您可能感興趣的ACCA試題

- 單選題 投資者已經(jīng)收集了以下四種股票的信息: 股票 β 平均收益(%) 回報的標準差(%) W 1.0 9.5 13.2 X 1.2 14.0 20.0 Y 0.9 8.4 14.5 Z 0.8 6.0 12.0 風險最低的股票是( ),。

- 單選題 公司賣出了一個看跌期權(quán),行權(quán)價格為$56,,同時購買了一個行權(quán)價格為$44的看漲期權(quán),;購買期權(quán)時股票的價格為$44;看漲期權(quán)費為$5,看跌期權(quán)費為$4,,目前的價格上漲了$7,,那么ABC公司因為看漲期權(quán)取得或是損失的金額為多少( ),。

- 單選題 在理性的市場情況下,,下列哪個投資有可能獲得最低的回報率( )。

津公網(wǎng)安備12010202000755號

津公網(wǎng)安備12010202000755號