Capital asset pricing model是什么_2023年ACCA考試FM知識點

如果自己不努力,誰也給不了你想要的生活,;夢想不會逃跑,,逃跑的永遠(yuǎn)是自己,。acca被稱為“國際財會界的通行證”,,含金量比較高,。每年都有大量考生報名參加考試,。今天為同學(xué)們整理了FM科目Capital asset pricing model(資本資產(chǎn)定價模型)相關(guān)知識點,,正在備考的同學(xué)們來看看吧。

【內(nèi)容導(dǎo)航】

Capital asset pricing model-資本資產(chǎn)定價模型

【知識點】

Capital asset pricing model-資本資產(chǎn)定價模型

Beta factor

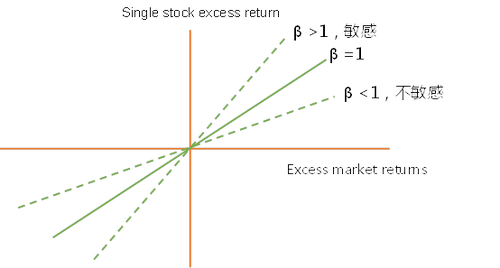

Beta factor is the measure of the systematic risk of a security relative to the average market portfolio. The higher the beta factor, the more sensitive the security is to systematic risk (the more volatile its returns in response to factors that affect market returns generally).

Beta factors | |

1 | This is the measurement of systematic risk for the stock market as a whole. |

0 | This is the systematic risk for risk-free investments. Returns on risk-free investments are unaffected by market risk and variations in market returns. |

Less than 1 | Systematic risk is lower than for the market on average. |

More than 1 | Systematic risk is higher than for the market on average. |

? For example, If β = 1, the market is up 10%, the portfolio is up 10%, the market is down 10%, and the portfolio is down 10%;

? if β = 1.1, the market is up 10%, the portfolio is up 11%, and the market is down 10%, the portfolio It will fall by 11%;

? if β = 0.9, the market will rise by 10%, the portfolio will rise by 9%, the market will fall by 10%, and the portfolio will fall by 9%.

不期待突如其來的好運(yùn),,只愿付出的努力終有回報,,愿每個認(rèn)真努力的現(xiàn)在,會有一個水到渠成的未來,。以上就是為大家整理的acca考試相關(guān)知識點,,2023年6月acca考試在即,同學(xué)們要抓緊時間復(fù)習(xí),。

注:以上內(nèi)容來自Echo老師FM精講班第27講

(本文為東奧會計在線原創(chuàng)文章,,僅供考生學(xué)習(xí)使用,禁止任何形式的轉(zhuǎn)載)

津公網(wǎng)安備12010202000755號

津公網(wǎng)安備12010202000755號