Dividend growth model是什么_2023年ACCA考試FM知識(shí)點(diǎn)

天行健,,君子以自強(qiáng)不息;地勢(shì)坤,君子以德載物,。acca被稱為“國(guó)際財(cái)會(huì)界的通行證”,,含金量比較高,。每年都有大量考生報(bào)名參加考試,。今天為同學(xué)們整理了FM科目Dividend growth model(股利增長(zhǎng)模型)相關(guān)知識(shí)點(diǎn),,正在備考的同學(xué)們來(lái)看看吧。

【內(nèi)容導(dǎo)航】

Dividend growth model-股利增長(zhǎng)模型

【知識(shí)點(diǎn)】

Dividend growth model-股利增長(zhǎng)模型

Dividend growth model

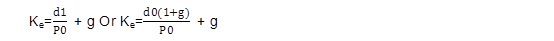

Shareholders will normally expect dividends to increase year by year and not to remain constant in perpetuity. In the case of constant dividend growth, the cost of capital is calculated as follows:

where ke is the cost of equity capital

d0 is the current net dividend

P0 is the current market price (ex div)

g is the expected annual growth in dividend payments

NB: If there is a dividend about to be paid and the share price is cum dividend, then the share price needs to be adjusted to ex dividend price.

馬行軟地易失蹄,,人貪安逸易失志,。以上就是為大家整理的acca考試相關(guān)知識(shí)點(diǎn),2023年6月acca考試在即,,同學(xué)們要抓緊時(shí)間復(fù)習(xí),。

注:以上內(nèi)容來(lái)自Echo老師FM精講班第27講

(本文為東奧會(huì)計(jì)在線原創(chuàng)文章,僅供考生學(xué)習(xí)使用,,禁止任何形式的轉(zhuǎn)載)

津公網(wǎng)安備12010202000755號(hào)

津公網(wǎng)安備12010202000755號(hào)