Capital structure theories是什么_2022年ACCA考試FM知識(shí)點(diǎn)

事常與人違,事總在人為,。acca被譽(yù)為“國(guó)際財(cái)會(huì)界的通行證”,,含金量比較高,。同學(xué)們?nèi)粝胍淮瓮ㄟ^ACCA考試,,需要嚴(yán)格執(zhí)行學(xué)習(xí)計(jì)劃,,鞏固基礎(chǔ)知識(shí)點(diǎn)。今天為同學(xué)們整理了Capital structure theories(資本結(jié)構(gòu)理論)相關(guān)知識(shí)點(diǎn),正在備考的同學(xué)們一起來(lái)看看吧,。

【內(nèi)容導(dǎo)航】

Capital structure theories(資本結(jié)構(gòu)理論)

【知識(shí)點(diǎn)】

Capital structure theories(資本結(jié)構(gòu)理論)

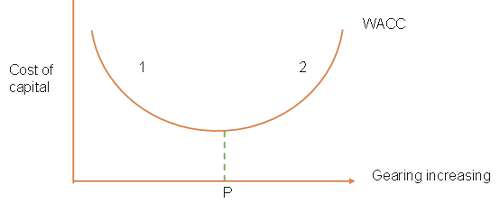

The traditional view

(a) As the level of gearing increases, the cost of debt remains unchanged up to a certain level of gearing. Beyond this level, the cost of debt will increase.

(b) The cost of equity rises as the level of gearing increases and financial risk increases. There is a non-linear relationship between the cost of equity and gearing.

(c) The weighted average cost of capital does not remain constant, but rather falls initially as the proportion of debt capital increases, and then begins to increase as the rising cost of equity (and possibly of debt) becomes more significant.

(d) The optimum level of gearing is where the company's weighted average cost of capital is minimised.

The traditional view about the cost of capital is illustrated as follows:

一鍬挖不成水井,一天蓋不成羅馬城,。以上就是為大家整理的ACCA考試相關(guān)知識(shí)點(diǎn)了,,同學(xué)們要嚴(yán)格執(zhí)行學(xué)習(xí)計(jì)劃,鞏固基礎(chǔ)知識(shí)點(diǎn),,爭(zhēng)取一次通過ACCA考試,。

注:以上內(nèi)容來(lái)自Echo老師FM精講班第29講

(本文為東奧會(huì)計(jì)在線原創(chuàng)文章,僅供考生學(xué)習(xí)使用,,禁止任何形式的轉(zhuǎn)載)

津公網(wǎng)安備12010202000755號(hào)

津公網(wǎng)安備12010202000755號(hào)